Recent research revealed that 1 in 10 people currently invest in cryptocurrencies, with 65% of those cryptocurrency investors jumping into the asset class in the last year.

Table of Contents

What is cryptocurrency?

Bitcoin is believed to be the founding cryptocurrency. Created in 2009 under the pseudonym Satoshi Nakamoto, bitcoin initiated the new age of blockchain technology and digital currency.

A cryptocurrency is a virtual currency secured by cryptography. It is a digital asset that can be utilised to purchase things. Cryptography is the secret writing that makes it almost impossible to counterfeit or spend the value more than once.

Most cryptocurrencies are decentralised networks based on blockchain technology. Blockchain is basically a digital ledger of transactions that makes it difficult to cheat the system.

How is the value of cryptocurrency determined?

Cryptocurrency isn’t based on a specific asset so there isn’t established value. The value is decided by supply and demand. Increased demand will accelerate the value of a digital coin.

The other factors that impact the value include how the token is utilised, increase of adoption, rise in popularity among the masses and governments and countries investigating how they can effectively implement cryptocurrencies.

Cryptocurrency use guide

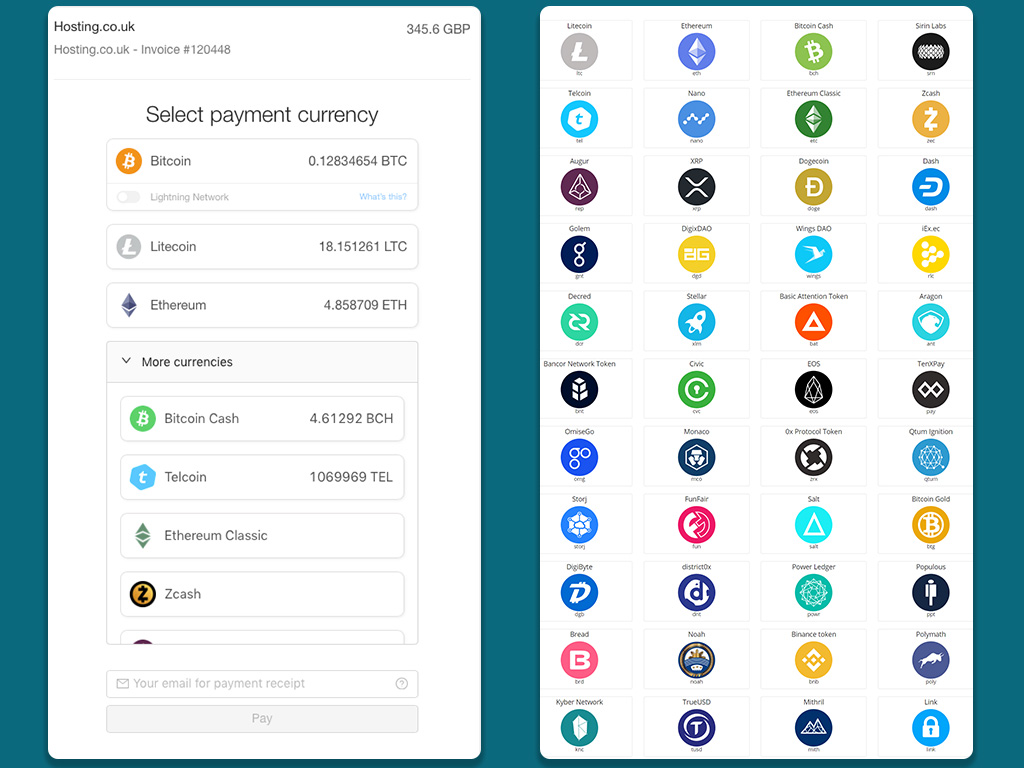

There has been a huge influx of crypto-investors over the last year which is why hosting.co.uk has researched the UK’s most popular cryptocurrencies extensively to highlight where they can be converted, spent and withdrawn.

The three top cryptocurrencies according to Statista are:

- Bitcoin

- Ethereum

- Dogecoin

Bitcoin

The bitcoin software was released in January 2009 as open source code. As of early September 2021, one bitcoin was worth £33,776.83.

Where can bitcoin be spent?

Hosting.co.uk found that bitcoin can currently be spent at:

- Website Hosting Companies

- Academy for Distance Learning

- Alegol.com

- Bells & Whistles

- British Podcast Studios

- Citadel Servers

- City Cigars

- Diadem Jewellery

- Firethought

- Gamesplanet

- Heirloom & Perennial

- Himalayan People

- IronSocket

- Lee’s Driver Training

- One Stop Grow Shop

- Plumb & Bath

- Red Robot Media

- Lindleys Autocentres

- KJP Images

- Guitar Theory Revolution

Where can bitcoin be converted?

Research shows that within the UK bitcoin can be converted at:

- Binance

- CEX.io

- LocalBitcoins

- BC Bitcoin

- EXMO

- Coinmama

- Uphold

- eToro

Ethereum

Ethereum was created in 2013 by programmer Vitalik Buterin and went live in 2015. The operating system works cross-platform and allows anyone to deploy permanent decentralised applications onto it. On the 8th of September 2021, 1 Ether was worth £2,476.88.

Where can ethereum be spent?

Within the UK, hosting.co.uk found that ethereum can be spent at:

- Gipsybee

- Peddler.com

- Flubit

- Direct Voltage

- OpenSea

- Spheroid Universe

- FLOGmall

- Openbazaar

- Trippki

- CheapAir

- Tripio

- Travala

- EGifter

Where can ethereum be converted?

Hosting.co.uk found that ethereum can be converted at:

- Binance

- CEX.io

- BC Bitcoin

- EXMO

- Coinmama

- Uphold

- eToro

Dogecoin

Dogecoin was started in 2013 by Jackson Palmer and Billy Markus. They originally started it as a joke based on the meme featuring a Japanese dog breed, the shiba inu. 1 dogecoin is worth £0.22 as of September 2021.

Where can dogecoin be spent?

Dogecoin can spent in the UK at:

- WebTraffic.App

- 1xBit

- HostMeNow

- Bitcryptomarket

- FederalMiner.com

- Rogue Origin

- CoinPayments

- Dynasty Goddess Hair

- Calypso Eco Soap Factory

- Pheromonexs.com

- Theraprina

- Parfum Palais

- Oakbank Organics

- Three Angry Kids

Where can dogecoin be converted?

Hosting.co.uk’s research found that dogecoin can be converted at:

- Binance

- CEX.io

- BC Bitcoin

- EXMO

- Coinmama

- eToro

Where can the top 3 cryptocurrencies be withdrawn?

Bitcoin, ethereum and dogecoin can all be converted to FIAT currencies (USDT, USDC, GBP, USD, etc) in an exchange mentioned above and withdrawn as currency at:

- Royal Bank of Scotland

- Standard Chartered Bank

- Nationwide

- TSB Bank

- Barclays

- NatWest

- Xace

- Orounda

- Cashaa

- Revolut

- Fidor

- most cryptocurrency exchanges (CEX.io, EXMO etc.)

Bitcoin can also be withdrawn at cryptocurrency ATMs across the UK.

Disadvantages of cryptocurrency

Cybersecurity is an issue we all face living in a digital world and for cryptocurrencies it is no different. Cryptocurrency will require much more enhanced measures than traditional financial institutions.

Due to the lack of clear value, price volatility is a drawback. It can be overcome by identifying value directly with assets but this takes away from the supply and demand approach thus far.

Cryptocurrency is not regulated which has it’s advantages but this also brings with it logistical concerns and risky investments.

If cryptocurrency can’t raise enough funds then the digital currency will collapse which is why so many creators are confirming commitment of resources and demands. However there is still the problem of the potential shortage of resources.

Worldwide cryptocurrency is not widely accepted, as you can see above there are very specific places where the three largest cryptocurrencies in the UK can be spent. Currently this means that digital currencies cannot be relied on completely.

Advantages of cryptocurrency

Firstly, cryptocurrencies have user autonomy which means that because they aren’t connected to policies created by governments the investors are in control of their money.

We also know that cryptocurrencies have huge potential for return on investment in a short amount of time. High return is a benefit offered by digital currency.

Cryptocurrencies are more risky for investors however the advantage is that there is a shorter cycle on investing which means that as cryptocurrencies are network based, cashing out can happen quickly when necessary.

As a rule transactions are completed on a peer-to-peer basis which means that users can send and receive payments within the network worldwide without external authority required.

There are no banking fees with cryptocurrencies, no one is charging you to hold your digital assets or to withdraw them. For international transfers the fee is minimal.

Cryptocurrencies offer complete confidentiality. As transactions are made with pseudonyms it is possible to withhold your identity and rely purely on the transaction record.

Finally, when you complete a transaction in cryptocurrency it can’t be reversed. There will be an encryption method used to protect the digital currency but you can’t undo the transaction. The security offered by this technique is a big advantage of cryptocurrencies.