It is fair to say that cryptocurrencies are here to stay despite recent volatility and concerns they would fade out. There are literally hundreds of different cryptocurrencies available today. However, it is Bitcoin which paved the way for this new and exciting world of digital currencies. While the term Bitcoin is now commonplace amongst Internet users and investors it only stepped out from the shadows in 2009.

Table of Contents

What is Bitcoin?

The best way to describe Bitcoin is a cryptocurrency. This effectively, is digital/electronic cash that you cannot physically hold. Many people will be familiar with the Bitcoin image of a gold coin but there is no such physical currency. It is not something that you can pass from person to person. However, this description just scratches the surface.

The history of Bitcoin dates back to 2009. This was the year when the open source software which effectively administers the currency was released to the public. A group of people under the pseudonym “Satoshi Nakamoto” issued the currency. Though amazingly, in this world of readily available information, nobody actually knows who made up this group. Over the years there has been speculation about the leading lights of Bitcoin. The multi billionaire electric car entrepreneur/PayPal founder Elon Musk regularly mentioned as the founder of Bitcoin. He refuted these allegations time and time again creating conspiracy theories as bizarre as they are unfounded.

Decentralised and no central bank

If you look at any traditional currency around the world it will have its own central bank. It is also likely they have a whole host of regulations covering the transfer and use of the currency. So, ‘Big Brother’ is watching. The situation with Bitcoin and cryptocurrencies in general is very different. These are decentralised digital currencies which have no central bank and in effect no single administrator. It is probably one of the best open source currencies around with administration platforms and exchanges making the transfer of the coins seamless.

The fact that central banks and governments around the world have no direct control over cryptocurrencies has led to some uncertainty. Interestingly, as governments and banks attempt to reduce the attractions of cryptocurrencies by introducing regulations and usage guidelines, this has in fact given users and investors more confidence in the concept.

How many Bitcoins are there in circulation?

The way in which the Bitcoin system was set up has often been compared to panning for gold. Under the Bitcoin protocol, only a maximum of 21 million Bitcoins exists. In fact, as of September 2018 only “mined” 17.3 million bitcoins. This takes us onto a very interesting subject which is known as “mining”.

All Bitcoin transactions are recorded on what is known as a blockchain although this system does not directly identify the underlying individual/company sending or receiving the cryptocurrency. In order to verify the existence of a Bitcoin (or part of) each blockchain entry must relate to a previous transaction, then the previous transaction, etc. Powerful computer networks verify the process which requires a huge amounts of power supplies. This is extremely expensive. It is therefore something more associated with rich entrepreneurs and large corporations.

Digital currencies like Bitcoin exists only in electronic format in individual accounts. You can identify these accounts (wallets) by it’s address and unique private key together with a public key. So, if somebody was to find your address and unique private key then in theory they could take your Bitcoins. There are no refunds and tracing of transfers so if you send a payment by mistake it is highly unlikely you could reverse this.

Bitcoin for secure payments

The payment and verification process associated with Bitcoin payments makes the system extremely secure with the greatest risk from someone hacking your Bitcoin address and public/private keys.This lets you make instant transactions easily. There is no need for often time-consuming regulatory checks, and companies only receive the public key relating to a Bitcoin. This means that those scouring through public records to search for Bitcoin transfers could only send money to your public wallet and never have access to your private key and funds.

In many ways the security aspect of Bitcoin (cryptocurrencies in general) is more focused upon protecting your Bitcoin address, public and private keys and password protecting your computer. In many ways it is the basic nature of the Bitcoin payment process which makes it so secure with only the transfer system having access to your public and private keys.

Pay for your hosting with cryptocurrencies

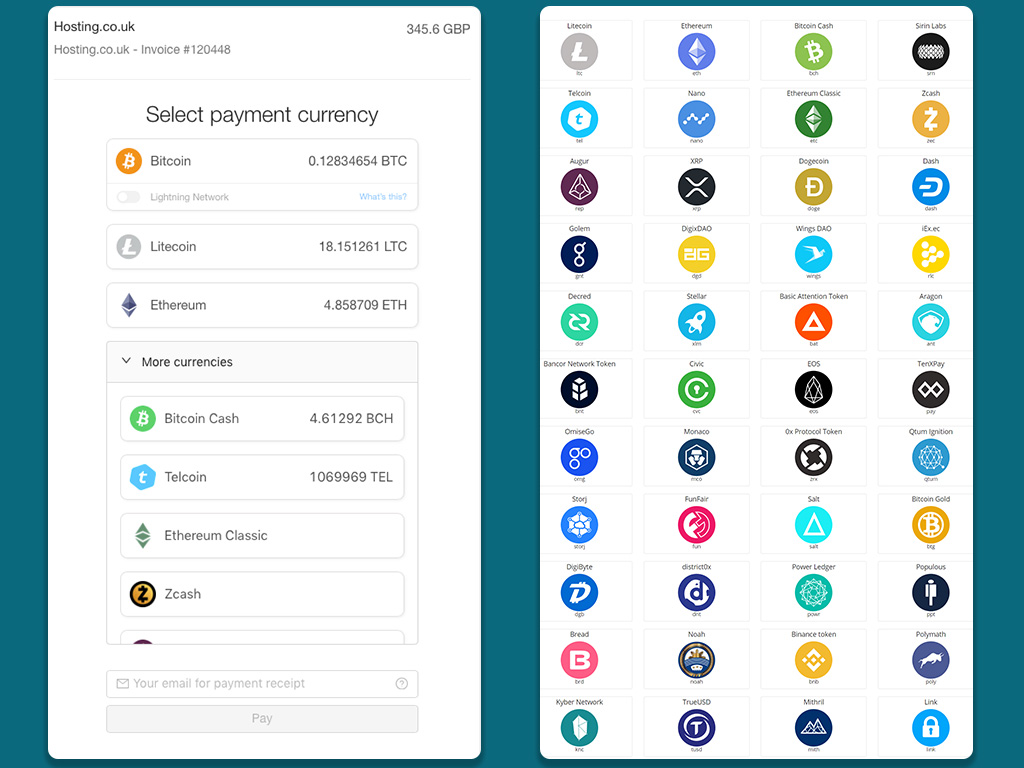

It seems only natural that the Internet and the digital world would eventually embrace the concept of cryptocurrencies. Bitcoin Hosting concept is growing in popularity. The enhanced security, autonomy and privacy afforded to cryptocurrency users attracts many companies. Here at www.hosting.co.uk we have now expanded the number of digital currencies that we accept. You can pay from a selection of more than 50 different cryptocurrencies which include:

- Bitcoin

- Litecoin

- Ethereum

- Bitcoin Cash

- Telcoin

- 2Ethereum Classic

- Zcash

Privacy and autonomy

As we touched on above, many governments and central banks around the world have attempted to hijack the cryptocurrency revolution. When they discovered this blocked route, many decided that regulatory restrictions would ruin the party. Fortunately, there is growing popularity for Bitcoin and other cryptocurrencies and there is no going back.

Privacy and autonomy are central to the cryptocurrency revolution allowing the transfer of money both locally and internationally at the touch of a button.

The secure cryptocurrency payment systems ensure privacy with only basic public information made available. This creates a valuable degree of autonomy although there are potentially ways and means of identifying individual parties.

When setting up a Bitcoin/cryptocurrency wallet you will need to provide various identification documents. Don’t worry these will never be public. This information will not be part of the blockchain process which records each cryptocurrency transaction. So, the degree of privacy and autonomy afforded to those using cryptocurrencies is much greater than that associated with more traditional currencies.

The fluctuating value of Bitcoins

In the early days when Bitcoin was an irrelevance, each Bitcoin was worth less than a cent. (An extremely small following) Bitcoin was seen as a novelty currency used by a very select group of websites and individuals it was no threat to mainstream currencies. However, as interest began to grow so the cryptocurrency revolution started.

Let’s look back to the first Bitcoin transaction on 22 May 2010. Then each Bitcoin valued just $0.008. However, a few days later, it increased by 900% to $0.08 – still a minuscule value. The first recognised commercial Bitcoin transaction occurred on 22 May 2010 with the purchase of two large Papa John’s pizzas for the princely sum of 10,000 Bitcoins. The commercial value of the transaction at the time was just $30.

To put this into perspective, on 11 December 2017 the value of one Bitcoin reached an all-time high of $19,357 which would value the initial pizza purchase at $193,570,000!

Even at today’s reduced value of $3,315 the Bitcoin pizza transaction would have a value of $33,150,000.

There is also the story of a Welsh IT worker who held 7500 Bitcoins on his computer hard drive, having acquired them when they were worth literally nothing. Unfortunately, while he removed the hard drive containing the Bitcoins for years, when replacing his computer, he accidentally threw it out. At the peak price of Bitcoins his holding would have been worth over $145 million and is still worth nearly $25 million today. Unfortunately, without his Bitcoin address and public/private keys he cannot access his account and the funds have gone.

Please contact us or click here for hosting.co.uk’s crypto-currency list of accepted currencies under our Hosting service that you can purchase with crypto.